Investing in real estate is a great way to make money, but it can also be complicated and overwhelming. In this article, we’ll walk you through the basics of investing in real estate with your IRA, and help you figure out the best way to go about it.

Everyone wants to make money in real estate, but many people don’t know how to get started. In this article, we’re going to show you the different ways you can invest in real estate and make money while doing so. Whether you’re looking to buy a property outright or invest in a property development project, we have the information you need to make an informed decision.

Whether you’re thinking of retiring soon or just want to have some extra money saved up, investing in real estate might be a great option for you. Not only can you make a decent return on your investment, but you also don’t have to worry about maintenance and other expenses associated with owning property.

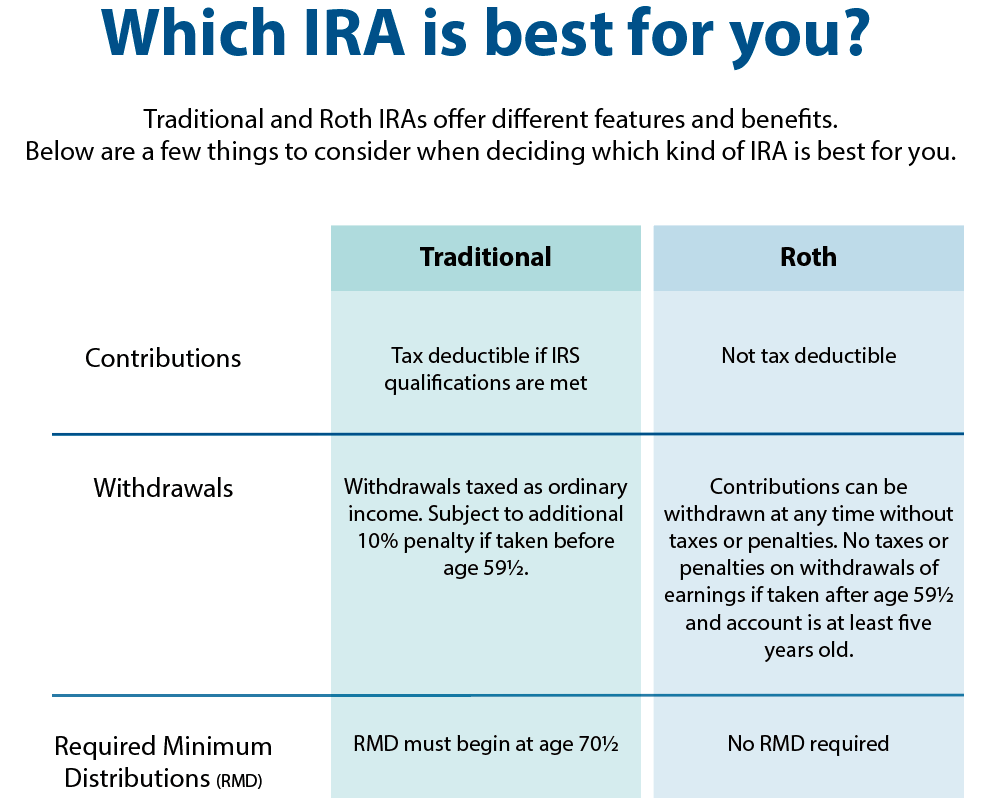

What is an IRA?

If you’re like most people, you probably think of an IRA as a retirement account. But in fact, an IRA can be a great way to invest your money, too. An IRA is a type of tax-advantaged savings account that allows you to save money for retirement. You can use your IRA to buy stocks, bonds, and other securities. You can also use your IRA to invest in real estate.

An IRA is an individual retirement account, which is a type of tax-advantaged savings account. You can use an IRA to save for your retirement, and you can also use it to invest in real estate. If you invest in real estate through your IRA, you can deduct the investment from your taxable income. This can help reduce your taxes overall.

Additionally, investing in real estate through your IRA offers other tax benefits, such as the ability to take advantage of the opportunity cost rule and the depreciation deduction.

Open a Self-Directed IRA

If you’re interested in investing in real estate, consider opening a self-directed IRA. A self-directed IRA allows you to invest in real estate without needing to involve a bank or other third party. There are a few things to keep in mind when opening a self-directed IRA for real estate:

1. Make sure the property you’re looking to invest in is eligible for investment through your IRA account. Generally, properties that are used for personal use, such as your own home, are eligible. However, some properties may not be allowed, such as commercial properties.

2. Consult with an accountant or tax specialist to make sure you’re following all the tax rules related to your IRA account and real estate investment. For example, if you’re investing in rental properties, you may be able to deduct interest paid on mortgages used to purchase the property from your taxable income.

3. Be prepared to do some research before investing in real estate through your IRA account. Understanding the market and the different types of properties available can help you make an informed decision about whether or not this is the right type of investment for you.

What are the benefits of investing in real estate with your IRA?

There are a number of reasons why investing in real estate with your IRA can be beneficial. First, Real Estate Investment Trusts (REITs) are regulated as investment trusts and are therefore subject to lower taxes than other types of investments. This means that your return on investment will be higher than with other types of investments.

Furthermore, many individual real estate investors find it difficult to get access to traditional lending sources, such as banks, so investing in real estate through an IRA can provide an alternative means of acquiring property. Finally, because real estate is a long-term investment, an IRA account will provide stability and growth potential over time.

How to invest in real estate with your IRA

Homes are one of the most popular investments for retirement account holders. Owning your own home can provide you with a sense of independence and security in retirement, while also providing a steady stream of income. There are a number of ways to invest in real estate with your IRA, and this article will explore a few of the options.

Don’t miss>>>

- 5 Types of Commercial Real Estate Loans

- Top 5 Tips for Financing Investment Property in 2022

- 7 Ways to Make Money in Real Estate

If you’re interested in buying a home outright, the best way to do this is through a conventional mortgage. You’ll need to have good credit and be able to afford the monthly payments, but this is one of the simplest ways to invest in real estate. You can also use your IRA to purchase homes through government-sponsored housing programs like FHA or VA loans.

Both of these options require a bit more paperwork and may have higher borrowing rates than a regular mortgage, but they’re still manageable options if you have the qualifications.

Another option for investing in real estate is through property investment trusts (PITs). These are special types of stocks that allow you to buy shares in companies that own properties or development projects.

Considerations when investing in real estate with your IRA

When looking to invest in real estate with your IRA, there are a few things to keep in mind. First, consider the type of property you want to purchase. If you are looking to invest in a rental property, make sure that the property meets all of the IRS requirements for rental properties.

Another thing to keep in mind is your tax situation. If you are self-employed, you may be able to qualify for a special tax treatment when investing in real estate with your IRA. You can find out more about this by contacting a tax advisor or by checking the IRS website.

Finally, be sure to always consult with an attorney before making any investments. There are a number of legal implications that can affect your investment, and it is important to have someone who understands these risks and can help you navigate them safely.

Invest in REITs

There are a few different types of real estate investments you can make with your IRA. One of the most popular is investing in real estate investment trusts (REITs). REITs are a type of mutual fund that invests in a variety of real estate properties, including apartments, office buildings, and shopping centers.

Why invest in REITs?

One reason to invest in REITs is that they offer diversification. This means that you’re not only investing in one type of property but a variety of different properties. Additionally, REITs tend to be more stable than other types of real estate investments. This is because REITs are regulated by the government, which makes them more likely to continue making profits over time.

How do I invest in REITs?

The easiest way to invest in REITs is through a mutual fund. You can find mutual funds that focus on REITs on the stock market. However, there are also exchange-traded funds (ETFs) that focus on REITs. ETFs are a type of mutual fund that trades like stocks on the stock market. This means that you can buy and sell ETF shares easily.

Use an Online Platform

One great way to invest in real estate is through using an online platform. Platforms like Zillow and Trulia allow you to research properties, compare prices and find the perfect property for your needs. Additionally, these platforms offer tools that can help manage your investment, such as alerting you when a property is listed for sale nearby or providing tips on how to negotiate a better deal.

An Individual Retirement Account (IRA) is a tax-advantaged account that allows you to save money for retirement. An IRA can be a great way to invest your money, and some of the benefits of investing in an IRA include:

• You can deduct contributions you make to your IRA on your federal taxes.

• The interest you earn on your IRA investments is tax-free.

• You can withdraw funds from your IRA without paying any penalties or taxes.

Strategies for Purchasing Real Estate

Investing in real estate with your IRA is a great way to get started in the market and grow your money over time.

Here are some tips to make the process easier:

1. Do your research. Before you invest, make sure you understand the market and what properties are available. Talk to friends, family, and local real estate agents to get an idea of what’s available in your area.

2. Get pre-approved for a mortgage. Before you purchase a property, make sure you have a pre-approved mortgage so you know exactly how much money you need to bring down the cost of the property.

3. Save up for a down payment. You’ll need enough money saved up to cover at least 20% of the purchase price of the property.

4. Make sure you’re comfortable with the investment. Make sure you’re ready to commit to owning this property for at least five years or more. If you can’t afford it long-term, don’t buy it!

5. Be prepared for repairs and maintenance costs. Properties can be expensive to maintain, so be prepared to shell out money on repairs and renovations down the road.